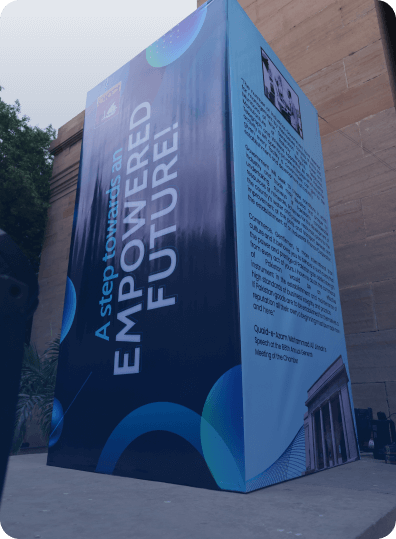

The First Port of Call for Foreign Investment in Pakistan

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.

The First Port of Call for Foreign Investment in Pakistan

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.

The First Port of Call for Foreign Investment in Pakistan

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.

The OICCI facilitates the transfer of leading global technology and business practices to Pakistan through the expertise of its members, benefiting all investors and the nation while partnering with the government to reform policy structures.